Credit cards have become an essential part of our daily lives. We rely on them for purchases, payments, and even managing our finances. However, have you ever stopped to think about the intricacies of a credit card? Understanding the anatomy of a credit card can help you make informed decisions, protect yourself from fraud, and manage your finances effectively.

In this article, we will decode the credit card and delve into its various components. From the magnetic stripe to the CVV number, each element serves a specific purpose and contributes to the overall functionality of the card. By knowing more, you can confidently navigate the world of credit and make wise financial choices. So, let’s dive in and uncover the secrets of the credit card!

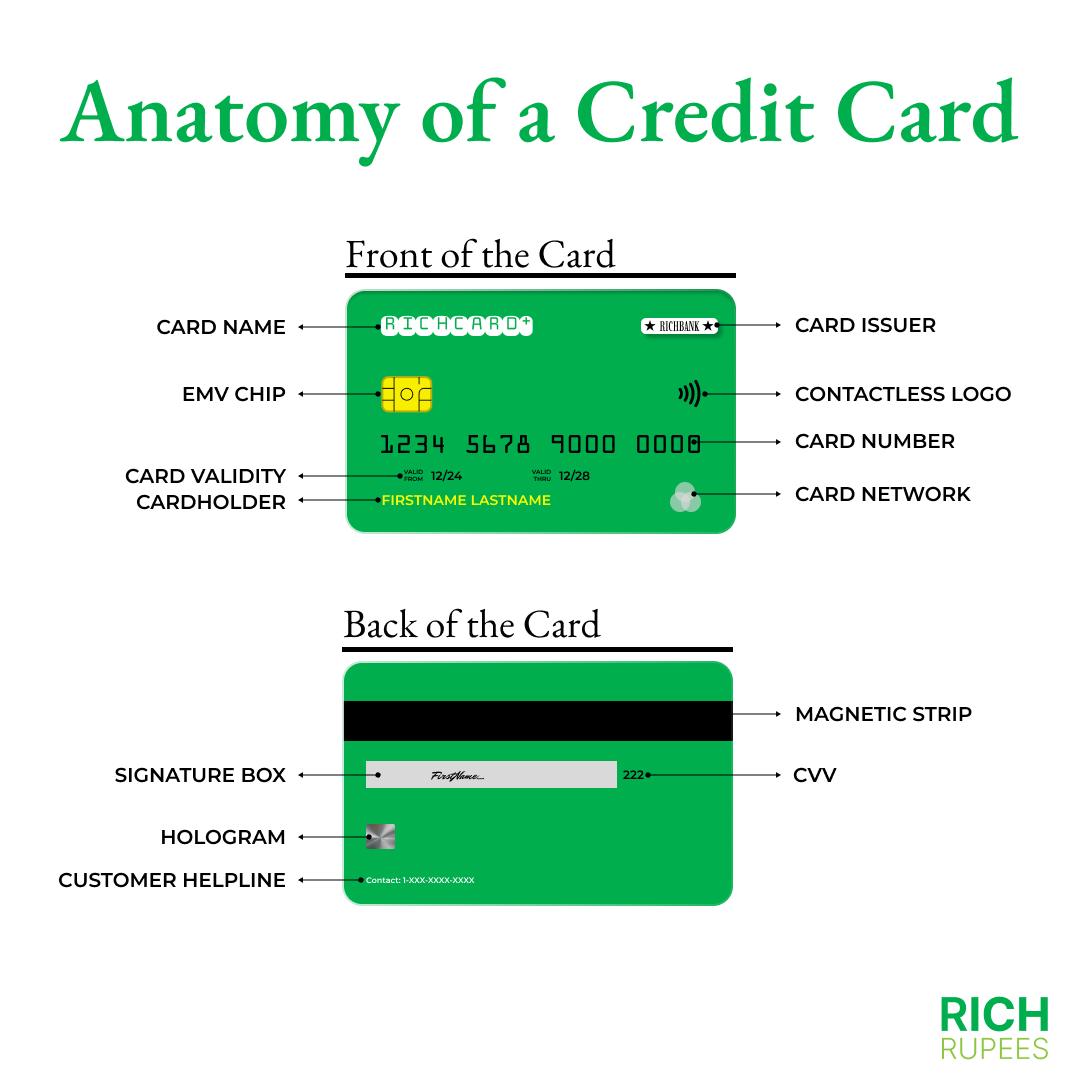

Anatomy of a Credit Card

Every credit card has two sides. Understanding both sides of a credit card is crucial to ensuring secure and successful payments in our mixed digital and physical world. Both sides of the credit card are important for completing transactions securely. When making a payment, the front side provides essential information for the merchant to identify the card and process the transaction. The back side, on the other hand, contains security features such as the signature strip and CVV code, which help prevent fraudulent usage.

Front of a Credit Card

Front of the card displays all the visually recognizable components of the credit card. It includes details such as the card’s number, the expiry date, the issuer of the card, and various other significant identifiers.

Credit card issuer

The entity that provides you with a credit card is known as the credit card issuer. This can be a bank, credit union, or other financial institution. The credit card issuer is responsible for overseeing the application process, determining the terms and conditions of the agreement, and managing the credit limits and any rewards program associated with the card. You will interact with the issuer for activities such as paying your bill, checking your balance, redeeming rewards, and reaching out to customer service.

The issuer’s name is usually mentioned on the card’s front side and is part of the card’s official name. As an example, ICICI Bank acts as the issuer for the ICICI Bank Coral credit card.

Credit card name

The credit card title changes according to the issuer and type of card. Generally, the credit card name consists of the card issuer’s name and the card type.

Each credit card name is unique, but there may be some resemblances. For instance, the names of the American Express Platinum Card and the American Express Platinum Reserve Card are quite similar. The front side of your credit card usually displays the name of the credit card.

Credit card network

The intermediary between merchants and banks is the credit card network. The acceptance of your credit card will be determined by the network you are using. Visa, Mastercard, Discover (parent of Diners club), American Express and India’s own RuPay are some of the major credit card networks. Typically, the logo of your credit card network is also displayed on the front of your card.

The significant distinction between the credit card issuer and the network lies in their respective roles. The network provides the necessary tools and system (payment backend systems) for you to carry out transactions at physical stores and online. On the other hand, the issuer focuses on the issuance and management of various types of cards.

Card holder name

The credit card holder name embossed or printed on the card is the same as the name of the person who owns the account. This is the name that you will use when you input the necessary billing details for any transactions. Typically, you can locate it on the front side of the card, although it may differ depending on the credit card provider. If you have given permission for someone else to use your credit card account, their name will be shown on the separate card issued to each user.

Credit card number

Although the majority of cards possess a 16-digit code, your credit card number can range from 13 to 19 digits and is unique to your specific credit card. This number consists of the issuer identification number, the bank identification number, and your personal card number.

When engaging in online or phone transactions, you will utilize your credit card number. It is crucial to refrain from sharing your card number with others for the sake of your own safety and security. The exact location of the number on your card may vary depending on the card issuer.

To enhance the security of your card number, it is advisable to use a virtual card when making online or phone transactions. A virtual card provides you with a temporary number, typically for one-time use, that is linked to your credit card account. This measure assists in preserving the security of your actual card number.

Chip EMV® Technology

The EMV chip, which stands for Europay, Mastercard and Visa chip, is present on every debit and credit card as a security measure against fraud. Instead of swiping your card, you will insert it into card readers to make transactions. This will generate a distinctive code tied to the purchase, unlike swiping the card’s magnetic strip, which lacks such capability. Typically, the EMV chip is located on the front of the credit card.

Date of account opening

The date of account opening refers to the month and year in which you established your credit card account. A few issuers may not include this date on the card, but for those that do, it is typically listed as MM/YY on the back of the card.

Expiration date

The expiration date of the credit card indicates when the card will no longer be valid and a replacement will be required. This date is also shown as MM/YY on the back of the card.

In most cases, the card is valid until the final day of the month in which the card will expire. Therefore, a card with an expiration date of 06/27 will usually be usable until the end of June 2027.

When making online payments, it may be necessary to provide the expiration date in addition to the card number and verification number.

Back of a Credit Card

When it comes to credit cards, most people are familiar with the front. But what about the back of a credit card? Many may not realize that this side is just as important. The back is typically where the cardholder’s signature is found, along with the three-digit CVV number used for online purchases.

Magnetic stripe

The magstripe, which is the magnetic stripe found on the back of your credit card, is not commonly utilized anymore. This magnetic strip holds personal information and can be deciphered by card readers during card swiping. In contrast, most card readers these days are designed to read the EMV chip on your card, requiring you to insert it. However, if both the card and the reader support contactless payments, you can simply tap your credit card on the reader. If your EMV chip malfunctions or if a card reader only allows for swiping, you may have to resort to using the magnetic stripe on your card.

CVV security code

The CVV, which stands for Card Verification Value, serves as an additional measure to prevent fraud and enhance security for your credit and debit cards. Typically, the CVV number on the back of your card has three to four digits. Each credit card has its own unique CVV, meaning that it will be different if you receive a new card. To ensure enhanced protection, you may be required to provide this number when conducting transactions online or over the phone. Like your card number, it is of utmost importance to keep your CVV confidential.

Customer service phone line

If you have any queries regarding your account or require aid with your card, the helpline for customers is the designated phone number you can dial. The customer service representatives are capable of assisting you with replacing your card, reporting any unauthorized transactions, making payments, as well as providing guidance on rewards and benefits for cardholders. Alternatively, for further information, you have the option to access your online account.

Signature box

Typically, the area where you will sign your card, known as the signature box, can be found on the rear side of your credit card. Some credit card providers may view this signature as a confirmation of your acceptance of the credit card’s terms. Merchants may also compare this signature to your in-person signature in order to determine if they correspond, although this method of verification is not as common nowadays.

Instead of a signature, some cardholders choose to write “see ID” in the signature box, prompting the merchant to ask for a photo identification before finalizing the transaction – a strategy used for preventing fraud. However, these days, it is uncommon for merchants to actually check for ID, especially when utilizing contactless payment or EMV chips.

The presence of this signature box on the back of your card may vary depending on the issuer of your credit card or the length of time you have had the card, as many card issuers no longer include it.

Hologram security feature

The hologram can be found on the front or back of your credit card as a small and shiny 3D sticker. It serves as an additional security feature, guaranteeing the card’s authenticity and making it difficult to replicate.

When making purchases in person, merchants should inspect the hologram to ensure your credit card is legitimate. However, it is not possible to verify the presence of the hologram for online transactions.

Conclusion

Both sides of the credit card are important for completing transactions securely. When making a payment, the front side provides essential information for the merchant to identify the card and process the transaction. The back side, on the other hand, contains security features such as the signature strip and CVV/CVC code, which help prevent fraudulent usage.

Understanding and safeguarding the card details on both sides of a credit card is necessary to protect against unauthorized use. In the modern world where payments occur both digitally and physically, this knowledge becomes even more crucial to ensure successful and secure transactions.